MACD Moving Average Convergence Divergence Oscillator

Contents

The ‘a’ and ‘b’ variables represent the periods in time which are used to calculate the MACD series. Spotting a trend is probably one of the most important tasks for every technical analysis trader. And while it may seem quite challenging, the MACD can be extremely helpful in this regard. While changing the above, could you avoid using crosses over in both bullish and bearish scenarios?

Notice in this example how closely the tops and bottoms of the MACD histogram are to the tops of the Nasdaq 100 e-mini future price action. This occurs because the MACD is accelerating faster in the direction of the prevailing market trend. A possible buy signal is generated when the MACD crosses above the zero line.

MACD has a positive value whenever the 12-period EMA is above the 26-period EMA and a negative value when the 12-period EMA is below the 26-period EMA. The level of distance that MACD is above or below its baseline indicates that the distance between the two EMAs is growing. Other platforms may refer to this as the “signal line”; the terms are interchangeable. This is an indication that momentum is starting to shift to downside, and a bearish reversal may be forthcoming.

Trending Articles

Spotting divergences is one of the most common and effective patterns in technical analysis. Patterns where the MACD shows divergence from prices can be an important signal although the pattern needs time to develop and should not be anticipated. Combining MACD line crossovers with other technical patterns can make the MACD system more reliable as a systems trading. As shown on the following chart, when MACD falls below the signal line, it is a bearish signal indicating that it may be time to sell. Conversely, when MACD rises above the signal line, the indicator gives a bullish signal, suggesting that the price of the asset is likely to experience upward momentum. Some traders wait for a confirmed cross above the signal line before entering a position to reduce the chances of being faked out and entering a position too early.

By comparing EMAs of different lengths, the MACD series gauges changes in the trend of a stock. The difference between the MACD series and its average is claimed to reveal subtle shifts in the strength and direction of a stock’s trend. It may be necessary to correlate the signals with the MACD to indicators like RSI power.

- On the price chart, notice how broken support turned into resistance on the throwback bounce in November .

- Even though the uptrend continues, it continues at a slower pace that causes the MACD to decline from its highs.

- Similarly, when the MACD crosses below the MACD Signal Line a possible sell signal is generated.

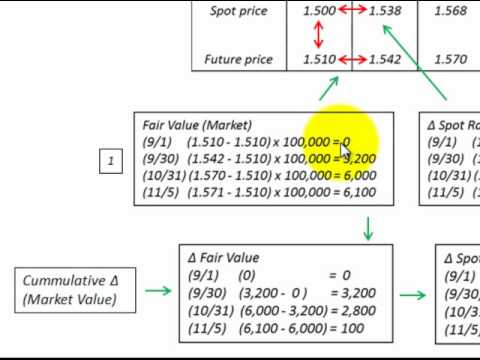

- The first value or cell D27 is average of the past 26 day’s closing prices, while cells D28 onward are in the formula above.

- Some traders wait for a confirmed cross above the signal line before entering a position to reduce the chances of being faked out and entering a position too early.

On a chart, the MACD is visualized as two lines, oscillating without boundaries. The shorter line is a 12-period Exponential Moving Average that moves quicker and is responsible for the majority of the MACD movements. The longer one is a 26-period Exponential Moving Average that reacts more slowly to price changes. Some traders attribute special significance to the MACD line crossing the signal line, or the MACD line crossing the zero axis. Significance is also attributed to disagreements between the MACD line or the difference line and the stock price .

Clustering Data into Groups, Part 2

The red line is the average or signal series, a 9-day EMA of the MACD series. The bar graph shows the divergence series, the difference of those two lines. The MACD moving average crossover is one of many ways to interpret the MACD technical indicator. Using the MACD histogram and MACD divergence warnings are two other methods of using the MACD. The blue line is the difference between the slow moving average and the fast moving average.

The first type of Zero Line Crossover to examine is the Bullish Zero Line Crossover. Bullish Zero Line Crossovers occur when the MACD Line crosses above the Zero Line and go from negative to positive. The Signal Line is an EMA of the MACD Line described in Component 1. The trader can choose what period length EMA to use for the Signal Line however 9 is the most common.

The modus operandi observed is that once a client pays amount to them, huge profits are shown in his account online inducing more investment. However, they stop responding when client demands return of amount invested and profit earned. MACD ExplainedIn the NIFTY Index chart above, the MACD indicators have been exhibited in the bottom panel. I’m curious now as to the formula for calculating the weekly MACD. Is the above formula suitable for calculating the weekly MACD?

How does the MACD provide traders with buy/sell signals?

The resulting signals worked well because strong trends emerged with these centerline crossovers. The MACD line is the 12-day Exponential Moving Average less the 26-day EMA. A 9-day EMA of the MACD line is plotted with the indicator to act as a signal line and identify turns. The MACD Histogram represents the difference between MACD and its 9-day EMA, the signal line. The histogram is positive when the MACD line is above its signal line and negative when the MACD line is below its signal line. MACD is an extremely popular indicator used in technical analysis.

To predict a MACD crossover keep an eye on the position of and the distance between the MACD and the signal lines. The distance will quickly shorten right before a crossover takes place. The closer it gets to the zero line , the bigger the chance for a crossover to take place. Okay, that’s trading house great, but what about the real trading signals? The hardest part to master with every trading indicator is finding out the best moments to place your buy and sell orders. The truth is that the Moving Average Convergence Divergence is among the most powerful forecasting indicators.

How To Read A MACD Histogram

Notice that the entries are very late and lag quite a bit, also it may be difficult to determine the crossover sometimes as the movement is very less and barely above/below the 0 line. The solution is usually to wait for bars to close and then take action in which case we get a proper signal. One way to use the MACD is to sell when the blue line crosses the red line downwards, this indicates a loss of momentum and selling pressure based on the EMA averages. Here is an example of the DLF hourly chart with the crossover signals. So, while the signal crossovers can be helpful, they are not always reliable.

The further away from zero, the stronger the generated signal is. A MACD crossover of the signal line indicates that the direction of the acceleration is changing. The MACD line crossing zero suggests that the average velocity is changing direction. 3) MACD Histogram – swings above and below a zero line, allowing bullish and bearish momentum readings to be distinguished. However, it’s important to realize that depending simply on one signal should never be used to decide whether to purchase or sell a certain coin.

Aspray’s contribution served as a way to anticipate possible MACD crossovers which are a fundamental part of the indicator. Where Time Period is 12, n refers to today, and n-1 refers to yesterday. Essentially, today’s EMA is a function of today’s closing price and yesterday’s EMA. The Moving Average Convergence Divergence indicator is a powerful momentum-based trading indicator. Use the excel formula below and copy down to calculate the signal data for all the dates.

The other problem is that divergence doesn’t forecast all reversals. In other words, it predicts too many reversals that don’t occur and not enough real price reversals. MACD is calculated by subtracting the long-term EMA from the short-term EMA . An EMA is a type ofmoving average that places a greater weight and significance on the most recent data points. This 9-period moving average is lagged behind the Value line, which makes it a good leading indicator for spotting potential reversals.

Centerline crossovers can last a few days or a few months, depending on the strength of the trend. The MACD will remain positive as long as there is a sustained uptrend. The MACD will remain negative when there is a sustained downtrend. The next chart shows Pulte Homes with at least four centerline crosses in nine months.

The prior potential buy and sell signals might get a person into a trade later in the move of a stock or future. The MACD indicator, also known as the MACD oscillator, is one of the most popular technical analysis tools. When the blue line is above the yellow line, it means the difference between a fast and a slow moving average is https://1investing.in/ big relative to the exponential moving average and vice versa. For example, Bullish Divergence occurs when price records a lower low, but the MACD records a higher low. The movement of price can provide evidence of the current trend, however changes in momentum as evidenced by the MACD can sometimes precede a significant reversal.

Featured Articles

This is a 9-day line that is commonly painted in red to illustrate price activity turns. The values of 12, 26 and 9 are the typical settings used with the MACD, though other values can be substituted depending on your trading style and goals. The content on this website is provided for informational purposes only and isn’t intended to constitute professional financial advice. Trading any financial instrument involves a significant risk of loss. Commodity.com is not liable for any damages arising out of the use of its contents. When evaluating online brokers, always consult the broker’s website.